Virtual cards for Instagram Ads are digital versions of standard bank cards, optimized for platform requirements. These cards streamline the payment process, reduce ad costs, and help track expenses. Here’s a guide with tips on selecting a virtual card specifically for Instagram Ads, using PSTNET as an example.

1. Ensure compatibility with Instagram Ads

Instagram is owned by Meta, which has strict security protocols for ad payments. Not all cards are suitable for Instagram Ads, so first make sure the card supports Visa or Mastercard — these networks generally work best with Instagram’s ad accounts. Check reviews on the platform you’re using to create your card to see how well it integrates with Instagram’s advertising.

PSTNET offers digital Visa/Mastercard options specifically for media buying. Their cards for Instagram Ads come with trusted BINs from U.S. and European banks, minimizing the risk of payment rejections. With over 25 BINs available, PSTNET allows unlimited card issuance, reducing the chances of running into risk issues.

2. Check fees and limits

Running ads often incurs additional fees that can impact your budget. When selecting a card, closely review its fee structure and any applicable spending limits.

PSTNET cards have significant cost advantages, with no fees on transactions, withdrawals, failed payments, or frozen card actions. This means each transaction—whether successful or not—comes without additional charges. Plus, PST.NET cards have no transaction limits.

3. Evaluate funding and withdrawal options

For ad payments, having straightforward funding options is key.

PSTNET cards offer various funding methods, including cryptocurrency (with support for 18 different coins like BTC, USDT TRC-20, ERC-20), bank transfers (SWIFT/SEPA), or Visa/Mastercard transfers. You can also withdraw funds to USDT without additional fees.

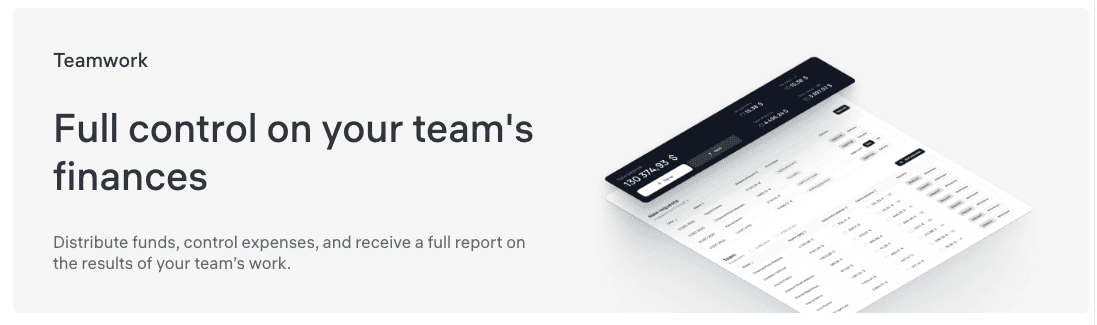

4. Look into extra features

In media buying, ease of managing multiple cards can make a big difference, so check if the card provider offers team-friendly features and expense analytics to track ad spend effectively.

PSTNET’s user dashboard includes tools for task allocation, role assignments, setting card limits, and requesting balance top-ups within teams. Financial transaction reports are also available, letting users analyze cash flow and track campaign performance.

Additionally, PSTNET offers a free online tool called Pulse BIN Checker, with a database of over 500,000 BINs. This tool can quickly verify a card’s BIN and give data on average spend, billing thresholds, and approval rates, ensuring the card hasn’t been compromised.

5. Consider special perks

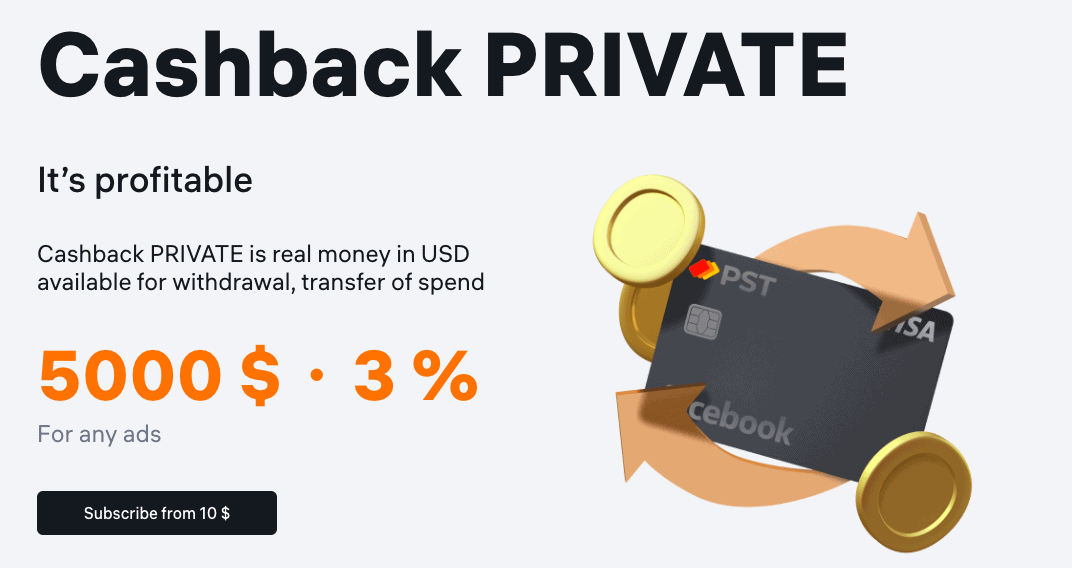

Many financial services offer ways to save on ads or optimize your budget through perks like cashback, free cards, or referral programs. PSTNET has special premium options with bonuses tailored for advertisers.

The PST Private program is specifically designed for media buyers and marketers. It includes both cashback and free cards. Users receive a 3% ad spend cashback credited to the card used for payments. Additionally, up to 100 free cards can be issued each month without needing budget verification; you just select a suitable plan on the website. Package options include Large, Medium, Small, and Extra Small.

PSTNET also has a referral program, offering up to 90% of the profit from referred clients.

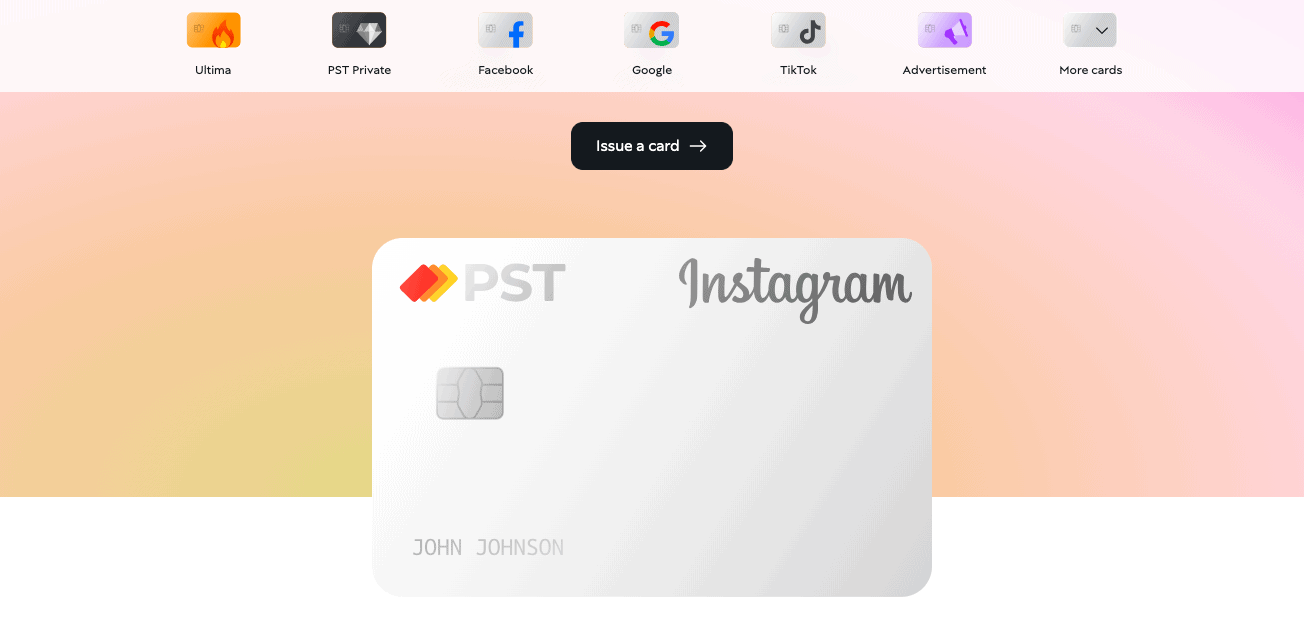

6. Assess card issuance speed and registration process

Quick response times are essential in ad payments. Choose a virtual card provider that can issue new cards swiftly.

PSTNET enables card issuance almost immediately after registration. You can sign up using your email, or Google, Telegram, or Apple ID. This will grant access to the user dashboard, where you can select the card you need for ad payments or join the PST Private program.

If you require mass card issuance or want to fund a card with more than $500, you’ll need to complete a simple verification process for security, typically taking no more than an hour in rare cases.

7. Ensure customer support availability

In finance, unexpected issues can arise, making responsive customer support crucial when choosing a virtual card.

PSTNET provides 24/7 technical support through Telegram, WhatsApp, or live chat. They also offer a multifunctional Telegram bot that sends service notifications and provides 3DS codes as needed.

Selecting the right virtual card for Instagram Ads is essential for minimizing ad expenses and simplifying campaign management. Look for a card compatible with Instagram, with transparent fees, secure funding options, and reliable support. Sometimes, testing a few options helps find the perfect fit. PSTNET’s cards are among the best, offering seamless payments on Instagram with no declines, plus 3% cashback and comprehensive expense analytics tools.